Glossary and definitions

Compliance

Know Your Customer (KYC)

Know Your Customer (KYC) involves obtaining and verifying customer records both at the start and throughout the relationship. This includes determining the necessary identification documents and understanding when additional checks are required. The core principle of KYC is to ensure that the customer is who they claim to be.

MKYC

One of the key barriers to financial inclusion for the mass market, our target customer group, is the complexity of the account opening process. The Bank of Ghana recognised this and introduced medium KYC (Know Your Customer) accounts with simpler requirements and strict operational limits. By leveraging this provision, the aim is to offer medium KYC accounts as an accessible entry point for the mass market into Affinity. This serves as the foundation of the financial inclusion journey for this segment. The ultimate goal is to encourage individuals and micro-enterprises in the informal sector to open accounts and gradually grow them to meet enhanced KYC requirements.

EKYC

These deposit accounts will be available to all individuals, both in the formal and informal sectors, who wish to upgrade from our medium KYC product to meet full KYC requirements, as outlined in the Anti-Money Laundering Regulations, 2011 (LI 1987), and countering financing terrorism regulations. For these customers, there will be no restrictions on transactions or balances.

Business types

Business type | Definitions | |

|---|---|---|

1. | Sole proprietor | A sole proprietorship is an unincorporated business that is owned and controlled by one person as the sole owner responsible for all the liabilities of the business. Essentially, the business and its owner are the same person. A sole proprietorship is the most common form of business organization in Ghana because it is simple to set up and cost-efficient. Source: |

2. | Limited liability | Company Limited by Shares is an association between two and fifty people with a set of objectives for either profit or non-profit basis. There are shareholders who are the owners of the company and directors, secretary and auditors who are the officers of the company. Source: |

3. | Partnership | A partnership is the coming together of two or more people to operate a business jointly for the purpose of making profits. A maximum of 20 people can exist under one partnership. Source: |

4. | Non-profit/NGO, Charity, Association, Embassy/Consulate or Club | This is a company set up for non-profit, social or charitable purposes. It is not allowed to create or issue shares. The personal liability of the members of a company limited by guarantee is limited to the amount that the individual members pledge to contribute to the assets of the company if the company has to be wound up. Source: |

5. | Government organisations | A government organisation is any enity that is wholly owned by the Government of Ghana. These include MMDAs, SOCs, etc. |

Other definitions

Businesses that require licenses

This refers to any business that is regulated and requires a licence to operate, including betting companies, financial services, telecommunications, etc

Ghana Post GPS

GhanaPostGPS is Ghana’s official digital property addressing system, covering every part of the country and providing each location with a unique digital address

Tax Identification Number (TIN)

A Taxpayer Identification Number (TIN) is used to uniquely identify taxpayers or potential taxpayers (both individuals and corporate entities) for tax purposes

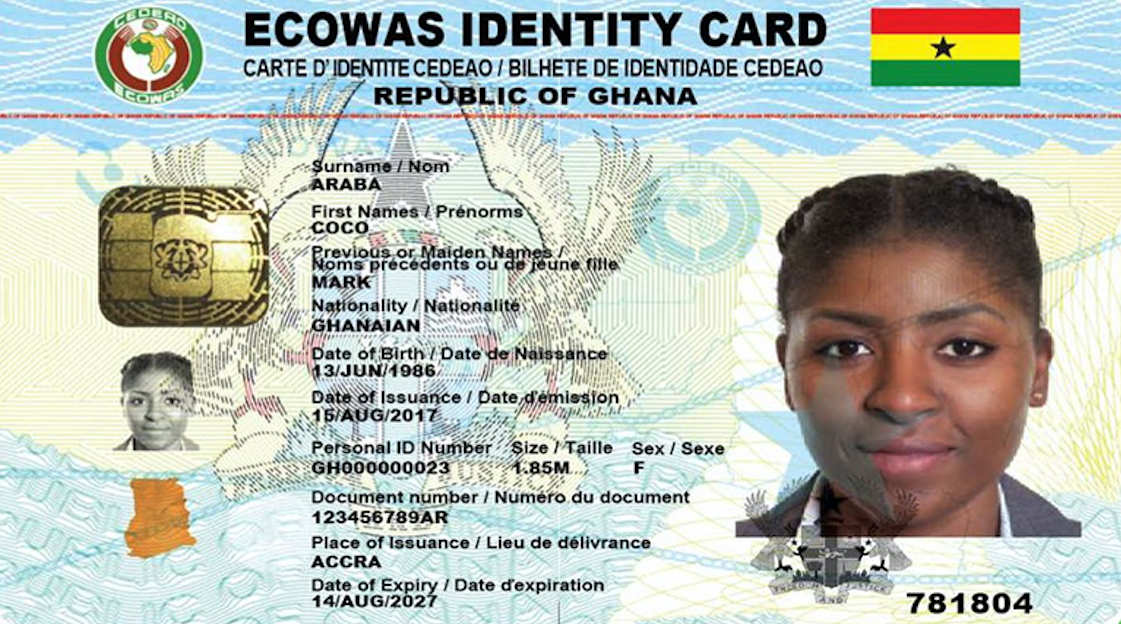

Ghana card

The Ghana card, also referred to as the National Identity card or Ecowas Identity card, is a secure, multi-purpose card that establishes the biometric identity of the holder. It is used for verifying and authenticating electronic and physical transactions across both public and private sectors.

Customer profile

A unique individual account holder on the platform

Business profile

A unique business account holder on the platform

Deposit account

A transactional bank account with a unique account number, capable of holding funds and facilitating transactions, including debits and credits

Account Management

Defines the level of control over the account created

Managed: total control over the account, including actions such as funding, withdrawals, etc

Not Managed: limited control over the account, where only funding is allowed